Financial Incentives

Keep more money in your pocket!

HERE’S HOW YOU SAVE

FEDERAL TAX CREDITS

The federal solar tax credit is the best way to significantly reduce the net cost of solar for both residential and commercial installations.

2022 Tax Year and Beyond

The Inflation Reduction Act extends the Federal Solar Investment Tax Credit of 30% through 2032! This tax credit is a dollar for dollar reduction on your federal tax liability.

The Inflation Reduction Act

Federal solar tax credits for residential systems have been extended. If you have been considering a new solar system, an expansion to your existing system, a solar battery backup, or the addition of a battery to an existing system, this is the time to maximize your savings.

How does this help me?

Unlike tax deductions, the Federal Solar Investment Tax Credit lowers your federal tax bill by subtracting the credit directly from the amount you owe. This puts more real dollars back in your pocket.

Virginia Solar Renewable Energy Credits (SRECS)

This program allows you to sell carbon credits produced by your solar system through an SRECs broker.

The Virginia Clean Economy Act

This legislation created an SREC market in Virginia through a renewable portfolio standard (RPS) beginning in 2020.

Renewable Portfolio Standard (RPS)

Virginia’s largest utilities are required to provide a certain amount of renewable energy every year or pay a fine. Purchasing SRECs from solar customers (you!) is a way for the utility to meet that requirement.

How does this help me?

SRECs are paid out quarterly to solar customers at current market price per 1000kWh sold and can be sold for up to five calendar years after their date of creation. Depending on your system size, SRECs can save you hundreds annually.

BONUS: Beginning January 1 2023, systems less than 25kWh are exempt from property taxation in VA.

How does it actually work?

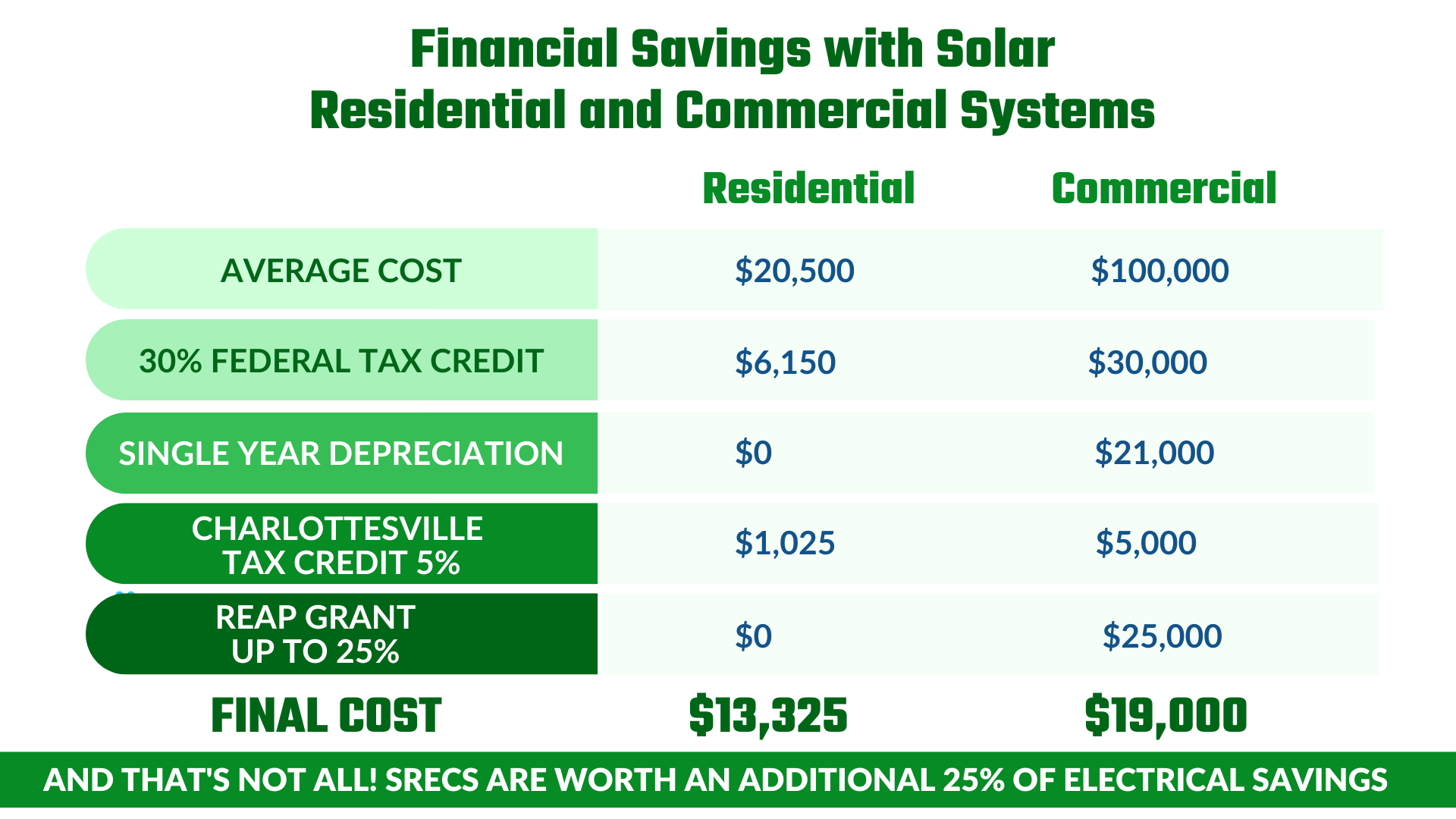

You install a solar system that costs $20,500.

You’re eligible for a $6,150 tax credit ($20,500 x 30% = $6,150).

If not fully utilized in one tax year, the remaining credit will roll into the following tax year.

Even more savings!

Charlottesville CITY RESIDENTS

Charlottesville City residents are eligible for a 5-year real estate tax credit. You can save 1% of the cost of your solar system each year which amounts to a 5% system cost reduction over five years.

Adding a solar system to a home will not increase the property tax despite the value of the property increasing.

COMMERCIAL INCENTIVES

Charlottesville: Commercial systems in Charlottesville may be eligible for an interest rate buy-down. Resulting interest rates may be as little as 2%.

Non-Profit: Non-profits in Charlottesville may be eligible for an interest rate buy-down. Resulting interest rates may be 0%.

Accelerated Depreciation: 100% bonus appreciation can be taken in the first year.

REAP Grants: The Rural Energy for America Program promotes energy efficiency and renewable energy for agricultural producers and rural small businesses through the use of grants and loan guarantees. Maximum benefits may be 25% of system cost.